There is no debt ceiling crisis: an explainer

An evergreen guide to debt ceiling reporting and why this time is not in fact different.

There are four main points I want to make here, emphatically:

The US government is not going to default on its debt. Not now, not soon, very likely not ever. The odds aren’t 20%, or even 2%. For it to ever happen the world would have to be structured very, very differently from how it is today.

The idea that a default could happen is a pure political fiction used by both parties as they wrestle for leverage in the eventual deal. Nothing more.

Every political journalist who doesn’t know this is either too green or too naive to be writing about the subject.

Every political journalist who does know this but elects to fuel fear anyway either has the wrong employer or lacks in a certain type of seriousness.

Now, I don’t mean to say that journalists shouldn’t report on debt ceiling debates at all even if the debates are just perverse theater. But there are two ways of doing this:

Option A: “Ah, sure, we’ve evaded this catastrophe before. But the world is uniquely terrible now AND WHAT IF THIS TIME IS DIFFERENT?!”

Option B: “Yeah this is all bluffing. Here’s a detailed explainer on why a default won’t happen and why just ignoring it all is good for you and the country.”

To the degree that warning readers of the potential ramifications of a debt default is important, both options do this. But where the first does it in a way that can only leave the reader with pessimism and anxiety and a bit of actual hate in their hearts, the second gives them permission to quit doomscrolling and go touch a tree.

Of course, the second option isn’t great for selling newspapers. Which is why what follows in this post isn’t something you’ll ever find in one. Because once you read it, you’ll be free to ignore their future headlines.1 And they’d prefer you didn’t.

We reward corrections. See something wrong, misleading, or unfair? Use our anonymous Typeform or drop a comment in this post’s dispute doc.

The rules of the game

To set context, let’s start with a quote from then-Fed regional governor Jerome Powell, taken from a 2013 debt ceiling meeting. The agenda of the day was discussing new (extra-)extraordinary measures that they could employ to avoid defaulting on the debt if Congress burned through all the space created by the extraordinary measures already used by the Treasury. Someone suggested that they make their meeting minutes public, which led Powell to talk aloud about the game being played:

It seems to me you could argue […] that the very thought that we actually countenance a debt default would be destabilizing. You can also argue that […] if [what we’re discussing] actually looks like a good game plan, then it will make it less likely that the Congress will feel enough pressure to actually raise the ceiling.

Then as now, Powell and company were caught on a weird tightrope within a larger circus act. Get too cute about new measures and that might spook bankers and foreign governments who believed this all a mere ritual. But also a less spooky plan might end up being workable. Then you’d have the less existential but more annoying risk of Congress saying “ah yeah this is great for encore drama; let’s do it!”.

What happened then, as ever, was that Congress refused to do anything until the 11th hour, knowing that they too had their own game to play. Even if compromise was the only outcome and default was never a serious consideration, they had to come back to their bases with good stories. Strike a deal too early—even if it’s precisely the same deal you’d strike later—and you risk appearing weak. So the standard play is to wait until the last minute—ie. until all legal, low-risk workarounds have been used up—then sign a deal based on actual leverage and cry victory. Rinse and repeat.

Put another way:

Few politicians believe it in their interests to strike a deal without a bit of grandstanding first. Each wants a good press clip to take back to their home district about how they’re either Very Serious about tackling excess debt or Very Serious about refusing to let god’s sacred democracy be held at gunpoint.

Staff at the Treasury and the Fed ultimately serve at the pleasure of the President. They’re thus expected to cooperate and offer some performative minimum of contingency planning—ie. coming up with new potential measures and teasing very tentative plans that keep stakes high for voters and nil for markets.

If the Fed governors were instead to say “lol a default isn’t happening; we’ll be at the bar”, their boss would be displeased. So they never do.

If the newspapers covering this were to say the same, why would anyone click on their future coverage? So they never do either.

Now, you might think I’m being too cynical here. Surely this time could be different? Before I explain why it isn’t, let’s look at the rhetoric from past debates.

A story told in rhymes

As you’d expect if this were all just theater, journalists and politicians love pretending that current tensions are unprecedented. “Sure, sure, there have always been debt ceiling debates. But this one is a dogfight, and no side is backing down!”

Except, no, not really. So far as I can tell, both the rhetoric and the process of eventual compromise have always been roughly the same.

Take this NYT headline from 1987:

CONGRESS PASSES EMERGENCY RISE IN DEBT CEILING

“Emergency”, you say! How close were we to doomsday?

Approval came just days before the Government would have run out of cash and defaulted for the first time in history.

But this reprieve was just temporary, with a wider agreement taking another two months or so. Quoting from President Reagan’s speech on the latter date:

[…] the choice is for the United States to default on its debts for the first time in our 200-year history, or to accept a bill that has been cluttered up. This is yet another example of Congress trying to force my hand…

Unfortunately, Congress consistently brings the Government to the edge of default before facing its responsibility. This brinkmanship threatens the holders of government bonds and those who rely on Social Security and veterans benefits. … It's time for a clear and consistent policy to reduce the Federal budget deficit.

Sound familiar? And note the word “consistently” already being used 35+ years ago.

Or how about 1995-1996, where a dual debt ceiling / budget fight led to two government shutdowns, and where a default was avoided via extraordinary measures that closely match the template that Yellen used this year.

Or how about 2002:

President Bush had urged the House to approve the measure before the government bumped against the current debt limit on Friday, leaving the Treasury … to choose between financial gimmickry to keep the government operating and failing to meet obligations, including the payment of Social Security benefits.

The vote was 215 to 214. It came when financial markets, already skittish about the wave of corporate financial scandals, were starting to become nervous about the possibility of a partisan standoff calling into doubt the credit worthiness of the United States government.

Note these individual quotes from that episode—which will also sound familiar, though you may be used to hearing them from reps wearing the other jerseys:

“Our fiscal house is in total disarray,” said Representative Jim Turner, Democrat of Texas.

“How can someone spend like a drunken sailor and then all of a sudden find religion when it comes to raising the debt limit?” Mr. Flake [Republican of Arizona] said. “This is like eating a big meal and then walking out on the bill.”

“This is a generational mugging,” said Representative John Tanner, Democrat of Tennessee.

And I just picked all those dates randomly from a list of past debt ceiling increases! I suspect that roughly 100% of them shared this same general tenor. The degree to which any of these negotiations have been amicable has been a question of leverage held by the minority party, nothing more. And in every case they’ve used their leverage for some marginal gains, not to seriously push for default.

But to understand why they have no actual interest in a default, we have to take a more granular look at what the various stages of a default actually involve.

Defaulting by degrees

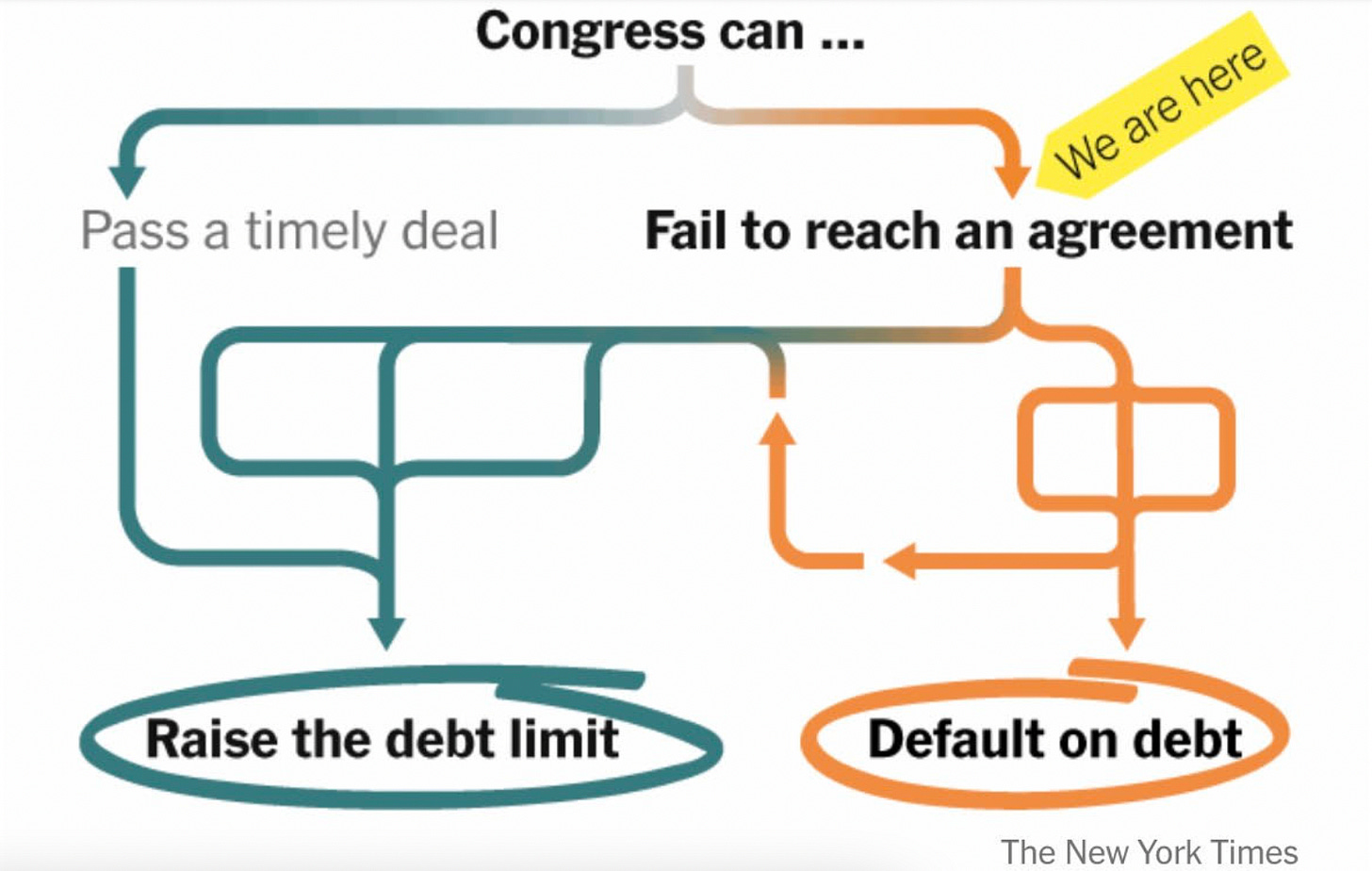

For the common but simplistic way of looking it, we have this graphic from the NYT:

Setting aside those baffling rectangular loops, this flowchart isn’t wrong per se. It just glosses over a more sequential process, where the amount of real risk being taken increases the closer we get to a true debt default.

[EDIT: I fucked up here. I’d only seen this static version of the flowchart and hadn’t realized it was from a series of (quite thoughtful) images that cover a full set of scenarios. I’ve added to my corrections tracker. Out of healthy respect for the NYT’s ethics policy, they declined to specify or endorse a non-profit for me to donate the corrections bounty to. So I’ve chosen my own. See note in tracker.]

For a clearer picture, imagine that there are two intermediate steps between that orange arrow and a hard default on debt payments—sort of like layers of insulation:

(As context here, the US Treasury basically has one massive checking account at the Fed. All the country’s tax payments and other revenues go in there, and then money is withdrawn to pay interest payments on federal debt along with a gazillion regular bills, including salaries for millions of government employees and contractors.)

Declining non-obligations / delaying future obligations. This is what most “extraordinary measures” are. Some Treasury activities are legally optional, and some buckets (mostly retirement accounts) that they need to pay into can be paid just as well tomorrow without anyone not getting their checks on time. So they just decline the optional stuff and write IOUs for the future payouts to keep more cash in the checking account. This buys them time before they need to borrow more money to replenish said account (which requires a raised debt ceiling).

Defaulting on current payment obligations. This could be deferring salaries for astronauts, soldiers, congresspeople, and mail carriers. Or it could be delaying pension payments and Medicare reimbursements. This would save that checking account balance for interest payments while making many people very angry.

Defaulting on debt payments. The nuclear option: declining to pay interest and maturity payments on outstanding government debt on pre-agreed dates.

Let’s look a bit closer at each of those in turn.

Step 1: declining non-obligations / delaying future obligations

Fun fact: this happens all the time, and always has. If you imagine that extraordinary measures are indeed extraordinary, you’ve been sold something. They were employed right from the first debt ceiling fight in 19552. Focusing on just the interval since the oft-cited 2011 megafight, extraordinary measures were used in 2012, 2013, 2014, 2015, 2017, 2018, 2019, 2021, and 2023. To not use them is the exception.

Though not at all extraordinary, these measures are certainly politically useful. Because again the game is: (1) create just the right amount of drama with voters, (2) create approximately zero drama with the markets. And saying “ah we’re doing EXTRAORDINARY measures” sounds suitably alarming in a headline while inducing little more than a yawn from bankers and foreign governments.

As such, we can expect that this will remain the norm until such time as the public wakes up to the game. To strike a deal ahead of these measures would be to risk appearing cowardly in the national drama, and to act too late to prevent a real default would be to induce massive risks with no real upside. Hence this sweet spot.

(Most readers will have heard talk of extra-extraordinary measures like the trillion-dollar coin, trillion-dollar gold monetization, premium bonds, and so on. While I suppose all are plausible, my sense is that it’s unlikely that any will be tried. Why? Return again to Jerome Powell’s comment from our first section. The Treasury and Fed are always going to be artfully vague about considering them while expressing “ah, risky risky”. They don’t want to give Congress any confidence that they’re safe, because Congress would absolutely use them to amp up the drama. That said, this Overton Window could shift over time, and maybe they will be used one day.)

Step 2: defaulting on current payment obligations

This is often referred to as a technical default. But before we get into the potential roadblocks here, the important thing to grok is that this almost certainly won’t even be tried. It’s just too politically costly. Delaying expected payments to tens of millions of Americans will cause real personal havoc for them, and will make them all very unhappy. As an individual politician, even if you think your party will come out slightly ahead on the blame game, you still have to return to your home district to face these voters! The risks vs. rewards here are just too lopsided, especially for House reps that have to run for reelection every two years.

Anyway, as for the mechanics:

Is the Treasury technically able to prioritize payments (ie. can they even program their payment infrastructure to pay debts but not salaries)? Though Yellen has said as recently as this year that “Treasury systems have all been built to pay all of our bills when they’re due and on time, and not to prioritize one form of spending over another,” this is an old and artful lie. It happens via the Fed, and they could.

Is the Treasury legally able to prioritize payments? This is trickier. The 14th Amendment (Section 4) is clear on “US debts must be paid”, but a bit ambiguous about payment obligations more broadly. That said, we can tell from the construction of this lawsuit and this old bill that prioritization would be both likely and very messy.

The most plausible legal resolution to me is that Congress would need to direct the Treasury on which payments to prioritize. But this is yet another reason I find the whole premise unlikely. From the POV of an individual politician, attaching your name to a bill that results in some group not getting paid is going to haunt you. So why would you ever do it? Much better to vote to kick the can down the road 3-18 months while taking whatever symbolic victory.

(There’s a theoretical argument that the Treasury wouldn’t even attempt to prioritize payment and would just default on debt and spending obligations concurrently. This seems to me a 0% likelihood. Given that debt repayment is a fairly small share of monthly payables compared to all other obligations, this would be to supercharge and globalize the overall damage while barely changing the situation for the masses.)

Step 3: defaulting on debt payments

Right, now we’re at DEFCON 1 territory: actually entering default on outstanding government debt.

As a fun aside, this has actually happened before, multiple times. One case in 1979 was caused by a multi-week computer glitch, and four other times were the result of either war debt or a policy change as to the conversion value between dollars and precious metals. While none of these cases are overly germane, I bring them up to reinforce that default—and the world’s response to it—is always contextual.

Crucially, no serious person believes that the US would remain in sustained default. America’s general creditworthiness is not actually in question. In the short term, this would be a bit like 1979, where the world has to navigate an unexpected blip as they await for the full repayment that all know is still forthcoming. Even so, this isn’t to suggest it would be no big deal. The world has gotten a lot more complicated since 1979. US treasuries are the effective oil of a great and hideously complex economic engine spanning the globe. Even a very short-lived default would cause gears throughout the system to grind in unpredictable—but very unwelcome—ways.

The truth is that we don’t quite know precisely how catastrophic this would be, and anyone who says they do is (at best) overstating. It’s a bit like the pandemic, in that informed people were certainly able to make educated inferences about some likely effects. But in a sprawling and interdependent system like global finance, very weird effects can emerge and no person alive has a real view of the entire system.

At minimum though:

Ratings agencies like Fitch would drop US credit ratings immediately. In a way, this is purely symbolic. Ratings are made to guide interest rates, and the US effectively sets it own rates. To the degree that external demand matters, there is no safer global instrument or meaningful commercial alternative to US treasuries—any temporary default notwithstanding. That said, many funds have rules about the credit ratings of their holdings, and navigating an overnight reassessment would be supremely annoying and chaotic.

Broken contracts, broken markets, and insolvencies would abound. The global financial system is built atop twin assumptions that payments from the US Treasury will always arrive as scheduled and that the value of Treasury-backed bonds will stay relatively stable day to day. While I’m skeptical that said values would actually change much in the weeks that followed a default (they actually improved after the ratings downgrade in 20113), there would certainly be unprecedented chaos over the first few days. This cleanup would cost enormous sums, and US taxpayers would revolt against all involved once they saw the bill.

It would mark the end of an era. While de-dollarizing various global markets is much easier wished for than done, this would give those movements one hell of a push. No one really wants to be in the history books as having accelerated the loss of what’s been one of the most significant economic advantages in history.

Though a very incomplete sketch, I trust this is enough to give a taste of the downside of a hard default. And on the other side, there’s…nothing? No one (apart from lawyers and maybe Putin) would really benefit from any of this. Even if the economic consequences were contained, it would be profoundly embarrassing. Every politician involved would have to expect to lose any future election, on top of some good chunk of their legacy. Trying to spin it as a victory to voters who’ve had their own payments delayed, watched their 401ks waver, and been shamed by the whole experience just isn’t plausible. While you could maybe find a few hardliner House reps insane enough to try it, you’d never find anywhere near as many as you’d need.

(Some clever readers might be wondering, “ah but if this is all so certainly not going to happen, how do you explain the rise in default insurance options on US debt?” For that I’d defer to this excellent breakdown from Matt Levine. In short, this increase isn’t really about anyone believing a default more likely. The potential payouts are just much higher now than usual thanks to a weird quirk of interest rates. An insurance policy with a 1% assumed chance of paying out will experience very different demand if it pays out $2,400 vs $2. But that extra demand has nothing to do with a change to payout likelihood. And there will always be some demand for insurance even for the most improbable outcomes, and some interest in gambling in general.)

Closing thoughts

This context all in mind, consider recent press framings.

The Washington Post, from late April:

Defaulting on the national debt is much closer than anyone realizes

The NYT, from a week ago:

The outcome of the debt ceiling conflict is genuinely uncertain.

CNN even found themselves some experts (this is from 2021, but relevant in that it’s mostly the same actors and the press is trying to spin this as more dire than 2021):

Goldman Sachs recently warned clients this is the “riskiest debt limit deadline in a decade,” since the 2011 showdown that rocked financial markets and caused the unprecedented downgrade of US debt.

… Eurasia Group estimates there is an “unusually high” 20% chance of a technical default…

If only more journalists understood what exactly these firms sell as products, perhaps they’d understand enough about their motivations to discount their rhetoric.

Anyway, we’ll end on the NYT’s doomy recap of yesterday’s debt ceiling summit:

Biden and McCarthy Reach No Consensus as a Possible Default Looms

But note that we only get the important part in the 12th paragraph, under two folds.

Senator Mitch McConnell … accompanied Mr. McCarthy to the meeting and endorsed his stance, insisting that the president had an obligation to compromise with the Republican-held House. But he emphasized … that he was committed to avoiding a default, hinting at some unease over the course of the debate. “Let me first make the point: The United States is not going to default,” he said. “It never has and it never will.”

Right, exactly. Never going to happen. A bipartisan team has already sketched out a deal framework. This faux controversy is destructive and exquisitely dumb. We’re eroding public faith for what exactly? Neither political party wins at this game—or even can. And neither can individual politicians! They’re just all so fucking scared of looking weak that they commit to this kayfabe despite knowing that a deal will be struck at the 11th hour—and never earlier—every, every, every time.

So how do we break the cycle? By explaining to the public what the game is rather than playing along. But newspapers have a lot to lose here! Debt ceiling fights are free premium content, as they have been for decades. So they’ll defend themselves along the lines of “well, look, readers vote with their clicks” and “we’re responsible to educate the public about the risk involved” and so on. But the great truth of journalism is that a press cannot depend upon its readers for ethical guidance. Virtually all of human history is a testament to why this is a hideously bad idea. Newspapers should know better, and most of them do. It’s time we held them accountable.

(If you’re a new reader, I’d encourage against a paid subscription unless you just want to support the cause. While I try very hard to make every post worth reading, my publishing schedule varies wildly. Free subscriptions are just as good.)

The counter-argument here is that it’s good to track the debate even if it is just theater because public polling can influence your political team’s leverage. Surely none of us want our side to get a worse outcome in the eventual compromise. But politicians already have maximal incentives and information to fight for their voters’ preferences, and the civic engagement on both sides mostly offsets anyway. Plus these deals tend to be largely symbolic and rarely advance or harm major policy causes on either side.

As a sidenote, some might say "hey, haven't the last 15ish years taught us to be more conscious of black swans?". Many things were once broadly considered unlikely—eg. the collapse of WaMU and Bear Sterns, Trump's election, the Brexit vote, Putin's invasions of Ukraine, the superspread of COVID—and some might think the right takeaway is to adopt a sort of epistemic humility.

My counter would be there are two types of humility really. One is to never consider a case quite closed—to seek and genuinely consider good counterarguments, to self-investigate closely for biases and blindspots, to consider which sources of confidence might be misplaced, and so on. This is certainly good! But another is to, as the saying goes, predict twelve of the last two recessions; to be so open-minded towards "well, it could happen" that we excuse ourselves from exercising judgment at all. And this I think is net bad. I certainly wouldn't turn to that person for a sense of which things to be anxious or not anxious about, or what to bet on.

Unlikely things do happen. But we can model why they did, and understand why the incentives of those with power made them possible. And in this particular case there just is no plausible model that I'm aware of that would open the door for a default. That said, this is also why I have an open bounty for people who bring forward POVs I missed, too easily discounted, or never considered.

Excellent piece Jeremy